Deduct the costs of your home office and set up your study cheaply

We are all familiar with home office, m obile working or teleworking, but not the possibility of deducting part of the expenses for your private office for tax purposes. The lack of technical equipment and ergonomic workplace conditions can become an expensive affair. Instead of jeopardizing your health and productivity, you can secure a comfortable workplace where you can work optimally with little effort and little money.

Why you shouldn't save on your study

Working from home is becoming a permanent solution for most companies. According to a study by the IFO, 56% of all jobs can be at least partially relocated to the home office, currently around 25%. Unfortunately, very few of us have had the time to prepare for working from home. The consequences are unconcentrated and ineffective work, up to and including permanent health restrictions, such as neck, shoulder and back pain. Anyone who spends several hours a day in front of the computer or laptop knows exactly what I'm talking about.

Until recently, it was almost exclusively the employer who took care of things like comfortable seating, eye-friendly lighting or technical equipment. Now everyone affected by home office is responsible for themselves.

Your health is most important

A chair or table that is unsuitable for the home office makes itself felt after just a single day, but what about after a month or even a year?

Diseases of the spine and back are responsible for a quarter of all sick leave days. 17.6% of all prescriptions for physiotherapy (physiotherapeutic services) are due to back pain. As you can see, pain that initially seems harmless is, in the long term, an enormous burden with far-reaching consequences for your health. If you save in the wrong place at your workplace, your body will be asked to pay instead.

Of course, these problems cannot be completely eliminated, but you can take preventive action and minimize the risk of health consequences. You can find many tips on this in other blogs on this page.

The obligations of the employer

You are being transferred to the home office, but do not have the optimal equipment?

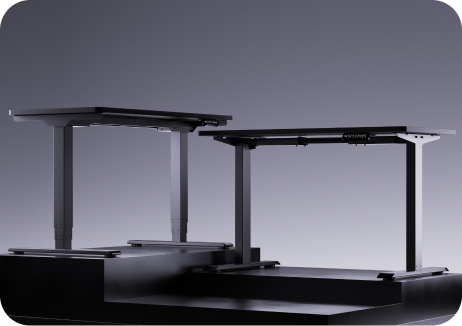

No problem, especially if you have to work from home, the employer is there too obliged to ensure the necessary measures for your safety and health. This responsibility is not in your hands. The goal is health prevention and meeting health standards. Examples of this are ergonomic features such as optimal seating or a height-adjustable desk.

The employer is also obliged to provide this equipment during the home office. (See Occupational Health and Safety Act)

Unfortunately, this fact is often neglected or completely disregarded. Just as it is the employer's duty to provide an office space, it is his duty to ensure the basic requirements for your home office. Of course, only if there is a need for a home office and the space allows it.

In addition, existing measures that pose a health risk must be reviewed and improved .

This includes considering the following questions:

- Is your seat suitable for doing daily work?

- Have eye-protecting measures been taken?

- Is your table suitable as a work surface?

- Is a favorable sitting position taken into account?

- Are you sufficiently equipped with technical means?

The clarification of these and many other questions is the responsibility of the employer, which leads to a significant financial relief for you.

Tax benefits

requirements

As always, there are a few requirements for your home office to be tax deductible:

-

The home office is arranged , not recommended

-

You work at home in a separate room

-

90% of the entire workplace is used to carry out the activity

What expenses are tax deductible?

- advertising and operating expenses

- Rent and utilities

- Internet and electricity costs

- renovation costs

- Setup costs, including all necessary measures to carry out the activity, such as desk, chair, lamp,

- Insurances that affect the study. For example home insurance

- A flat rate of 5€, per working day (maximum 600€)

- Any other expenses that cannot be avoided to make your work possible

Please note:

If most of your work is carried out in your study, you can deduct the costs in full, in other cases there is a limit of 1250€. All deductible factors relate exclusively to your study. For an accurate calculation, compare your workspace to your living space.

Quick example: This is how much money you can save

We assume average costs for all expenses. In our example, the working area is 15%

| Total cost | Tax savings (15%) |

| Rent 783€ | €117.45 |

| Additional costs 180€ | 27€ |

| Internet 30€ | 4.5€ |

| Home insurance €50 | 7.5€ |

| Flat rate per month | 50€ |

| Total monthly |

€206.45 |

| Total Annual |

2477.4€ |

The individual costs for furnishing and renovation, which can also be deducted if necessary, were not taken into account.

Do not forget the employer's obligation to bear all costs for enabling the activity.

Conclusion

As you have seen from the example, it is not worth saving a few hundred euros to set up your office and thereby jeopardizing your health. Be smart and get your money back.