Home office: These insurances are important in your own office

Regardless of whether you are an employee or a self-employed person – even when working from home you have to protect yourself against the risks of everyday life. Although the protection of the statutory accident insurance has been extended to the home office, in many cases you cannot avoid private accident insurance. In this article we look at which home office insurance policies are recommended for employees and the self-employed.

Basics of statutory accident insurance (also in the home office)

If you are employed, statutory accident insurance is part of your job. It is a branch of social insurance and is part of the compulsory insurance for employees . The basis for this is the seventh book of the Social Security Code.

These are the main tasks of statutory accident insurance:

- To protect against accidents at work and occupational diseases and the resulting health risks

- To restore the ability of an insured person to pay after an insured event has occurred

- To compensate the insured person or his surviving dependents in the event of a work-related illness

First and foremost , statutory accident insurance protects employees and trainees. However, there are also some other groups of people who can benefit from the benefits: employees of public interest institutions, children in day-care centres , people working in agriculture, the unemployed. In addition, you are also covered by statutory accident insurance if you are currently in hospital or in rehabilitation .

Statutory accident insurance in the home office

But what does it actually look like when you work from home ? In 2021, almost 25 percent of those in employment in Germany were at least partially working from home . Almost a tenth of the employees even worked completely from their own four walls. The statutory accident insurance also applies to you as an employee if you work from home.

In June 2021, the scope of statutory accident insurance was expanded in such a way that it also applies without gaps when working from home - as part of your work. So you are just as well insured in the company as you are in the home office. The accident insurance has the same scope as part of your work.

Important: If you go to the toilet or the kitchen in your home office, then this walk is always included in the insurance. Unfortunately, the actual use of the toilet or the preparation of your meal is not insured .

You also need this insurance in the home office

In addition to accident insurance, there are a number of other insurance policies in the home office as an employee . In the insurance conditions of your household contents insurance , you can often read that only private, but not commercial use of the rooms is insured. But does that mean that I have to take out additional insurance for the study?

No, because the room is only occasionally used for business purposes and therefore does not have to be reported to the insurer. Your home office is therefore automatically included in the scope of household contents insurance.

Info: What does household contents insurance actually insure? Household contents insurance protects all movable objects in your owner-occupied or rented apartment. This includes, for example, tables, chairs or the furnishings in your study . Damage can be caused by storms , fire, burglary or vandalism , for example.

Insurance as a self-employed person: you should know that

As a self-employed entrepreneur, you have to take care of most things yourself – including your insurance. In addition to the basics such as statutory or private health insurance , in this section we will look at which other insurances you should take out as a self-employed person.

Depending on the size and value of your company, public liability insurance can be crucial for you. It comes into play when customers, employees or visitors are harmed in your company and make a claim against you. Business liability also covers short-term failures of objects used for business purposes or medical treatment costs that exceed the legal framework. This makes it one of the most important types of insurance for the self-employed.

What do you do if your company building is destroyed or you cannot work for several weeks due to cyber damage? In such a case, as a self-employed person, you will not receive any continued salary payments and your rental and special costs will continue. You may have to pay employees, pay license fees or continue to pay electricity and heating costs. In the event of a longer interruption to operations, these costs represent an immense burden.

Business interruption insurance can therefore be a real livelihood saver for the self-employed. Should there be a breakdown in your company, it will cover the following costs, among others:

- Wages and salaries

- Rental and ancillary rental costs

- loss of profit

- All kinds of social spending

- Running costs for heating and electricity

Depending on the insurer, various causes of damage are also insured under business interruption insurance . Damage caused by tap water , fire, burglary or vandalism is usually included. Some insurers also include failures due to natural hazards in their insurance cover.

More tips for your home office

In addition to insurance, other points in your own home office are also important. So in the last paragraph we look at some more general points on how to best work in your own office.

We at desqup recommend that you set up your office as homely and comfortably as possible. In a familiar and beautiful atmosphere you are more concentrated and can perform better. Green plants belong in a good home office, for example, because they improve the air quality, among other things. In addition, the green color has a calming effect on the body and increases your productivity. With small personal items like pictures or gifts you make your office more personal and it almost feels like a living room.

Tip: Always place your desk at a 90-degree angle to the window. This way there are no reflections on the screen and you can always see everything clearly. In addition, the right illumination of your workplace increases your productivity.

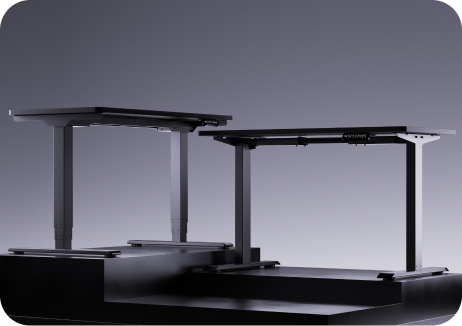

Ergonomic office furniture is also important so that you do not endanger your health even on long days. Desqup's mission is to make ergonomic sitting and standing stools and height-adjustable desks the standard in every office. The desqup Pro, for example, is a table that covers all important functions. An electric height adjustment, robust surface and a child lock make it the perfect companion in your everyday work.

For more information, please visit the desqup website !

Now you know the basics of home office insurance . Various policies ensure that you are ideally protected in your working life, both as an employee and as a self-employed person !